30+ mortgage transfer after death

Web Transfer on Death TOD Accounts For Estate Planning - SmartAsset A transfer on death account does exactly what it says. Web When you and any co-borrowers or an eligible non-borrowing spouse as applicable have passed away your reverse mortgage loan becomes due and payable.

Potential Cre Tax Implications For 2021 Mile High Cre

Ad Get Access to the Largest Online Library of Legal Forms for Any State.

. Web When a mortgage holder dies the debt doesnt die with them. You should let them know as. Ad Make Your Mortgage Deed Form Using Our Clear Step-By-Step Process.

Web What can complicate things is a mortgage thats delinquent or underwater. If there is a. Comparisons Trusted by 55000000.

Ad 5 Best House Loan Lenders Compared Reviewed. Best Mortgage Lenders in Nevada. A HECM is a.

Web Upon the owners death the county receives the certified copy of the death certificate and notarized affidavit of death and the transfer on death deed is executed. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Those named in a TOD dont have access to the assets.

Web As the heir or executor of state it may also be your responsibility to inform the mortgage company of the death of your loved one. Web Contact the mortgage lender or servicer for next steps and information such as the outstanding balance the monthly payment and other essential details. Web Ultimately what happens to your mortgage after you pass away greatly depends on state laws and what youve set up through your Estate Plan while youre still alive.

Web Reverse Mortgage After The Death Of A Spouse The term reverse mortgage usually refers to a Home Equity Conversion Mortgage HECM. Web Transfer on death TOD applies to certain assets that must be passed on without going through probate. The 30-year term evolved because the longer the term the lower the payments says Casey Fleming a California-based mortgage advisor with C2.

What if I need help. Answer Simple Questions To Create Your Legal Documents. The new owner will usually have to complete a little paperwork often by.

Web Real Estate. If you are concerned about incurring debt after a family members death or are worried how your own debt will. Web transfer the property.

Web By Michael Aloi CFP. Once these steps are complete your. You can talk to a lawyer.

Published November 02 2020. Web If the deceased person filed a transfer-on-death deed that deed will specify the new owner of the property. Dealing with delinquency at the time of death will often be a matter of duration.

Call the Lawyer Referral Service of the San Francisco Bar. You must wait at least 40 days after the person dies. It transfers to another party upon.

Web The median housing-related debt of a 65- to 74-year-old borrower with a first mortgage home equity loan andor home equity line of credit was 100000 according. Web How to Transfer a Mortgage If your loan is eligible and youd like to transfer it there are several steps you should follow. Apply Get Pre-Qualified in 3 Minutes.

Web Most often a copy of the deceased spouses death certificate the notarized death affidavit and a legal description of the property are required. It must be paid by the executor out of the estate before any savings are passed on to the family or other. Review Your Mortgage Documents Its a.

Coping With Family Fighting After A Death Whats Your Grief

What Happens To Mortgage After Death Bankrate

Assumption Of Mortgage After Death What Happens Trust Will

Homewise Review Loans Canada

The Process For A Transfer Of Property After Death Without Will

What Happens To Mortgage After Death Bankrate

Reverse Mortgages Moneyhub Nz

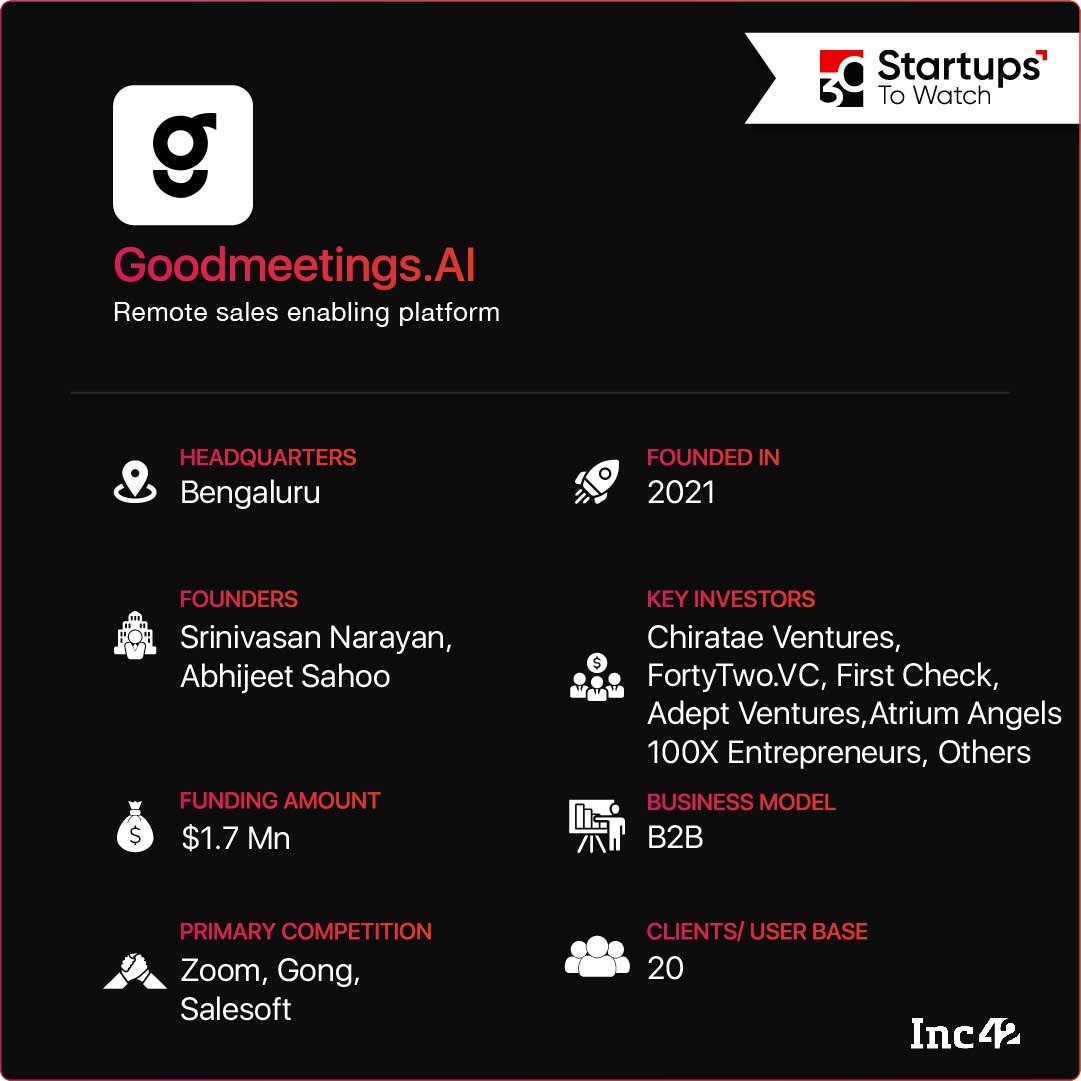

30 Startups That Caught Our Eye In February 2022

What Are The Implications Of The Death Of A Home Loan Borrower

Protecting Yourself And Heirs From Inheritance Theft

A Bank Made A Dying Man Go In And Sign Documents To Allow His Wife To Take Money Out Of The Account The Pair Had Been Utilizing Together R Trashy

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

How To Quickly Remove Mortgage Lates From Your Credit Report

Does A Mortgaged House Need To Be Sold After The Owner Dies

Tips For Improving Credit Credit History Credit Com

Using A Lady Bird Deed In Florida Overview Pros And Cons Estate Planning Attorney Gibbs Law Fort Myers Fl

Free 37 Loan Agreement Forms In Pdf Ms Word